浦发银行香港分行 - 浦发银行官网.pdf

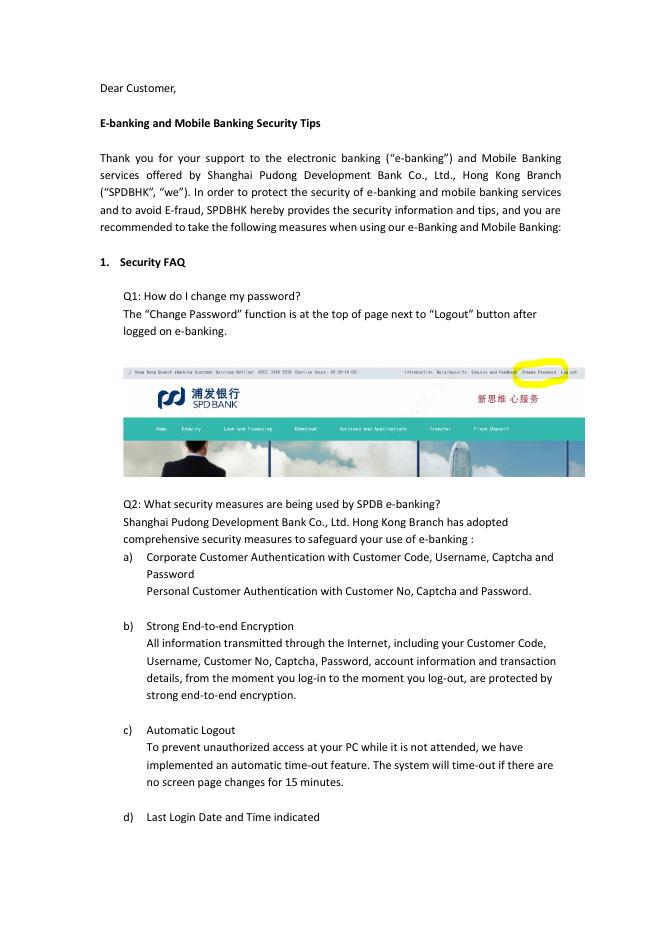

Dear Customer, E-banking and Mobile Banking Security Tips Thank you for your support to the electronic banking (“e-banking”) and Mobile Banking services offered by Shanghai Pudong Development Bank Co., Ltd., Hong Kong Branch (“SPDBHK”, “we”). In order to protect the security of e-banking and mobile banking services and to avoid E-fraud, SPDBHK hereby provides the security information and tips, and you are recommended to take the following measures when using our e-Banking and Mobile Banking: 1. Security FAQ Q1: How do I change my password? The “Change Password” function is at the top of page next to “Logout” button after logged on e-banking. Q2: What security measures are being used by SPDB e-banking? Shanghai Pudong Development Bank Co., Ltd. Hong Kong Branch has adopted comprehensive security measures to safeguard your use of e-banking : a) Corporate Customer Authentication with Customer Code, Username, Captcha and Password Personal Customer Authentication with Customer No, Captcha and Password. b) Strong End-to-end Encryption All information transmitted through the Internet, including your Customer Code, Username, Customer No, Captcha, Password, account information and transaction details, from the moment you log-in to the moment you log-out, are protected by strong end-to-end encryption. c) Automatic Logout To prevent unauthorized access at your PC while it is not attended, we have implemented an automatic time-out feature. The system will time-out if there are no screen page changes for 15 minutes. d) Last Login Date and Time indicated You should note that your last login date and time are provided for your verification. e) Using new computer to login e-banking You should note that you will receive SMS notification when using new computer to login our e-banking. SPDBHK always considers security to be of utmost importance. We have adopted high standards and tight control in managing our computer systems and networks. Q3: What is encryption and how is it used to protect my information? Encryption is used to prevent unauthorized parties from reading your information. Encryption is a security process that scrambles information for transmission at one end, and then decodes it for receipt at the other end. For our e-banking, all information transmitted between your browser and the Bank's systems are scrambled using strong encryption to protect the privacy and confidentiality of your account information. SPDBHK has deployed a TLS encryption technology to protect all your data transmitted over the internet. Q4: Can I log out from e-banking by closing the browser application? No, you should click the “Logout” button to log out e-banking. Q5: What should I do if I suspect there is unauthorized access to my e-banking or unauthorized transaction on my account? Please contact us via our e-banking Customer Services Hotline: (852) 216 95528. Security Information and Policy So as to protect the rights and benefits and the safety of information of our customers, SPDBHK hereby provides the security information and policy regarding our e-banking services. 2. Latest / Important Security Information 1. Customers are reminded to stay vigilant to anything abnormal when logging into the e-banking (e.g. unusual pop-up screens, unusually slow browser response, multiple requests for password input etc). 2. During the e-banking logon process, we will not request customer to enter any numbers to his/her security device to obtain security code. In case of doubt, please do not follow the instructions of the suspicious web page or input any data and close the browser immediately. 3. Customers are reminded to keep personal information / authentication factors (including password, message and mobile token) secure and to ensure not to knowingly or accidentally share, provide or facilitate unauthorised use of such 4. 5. 6. 7. 8. 9. details. Customers shall destroy the original printed copy of Password or PINs after use. We will not enquire customer’s personal information, e.g. user name, password, one-time password or other account details by email, SMS or by phone. When choosing username and password, customers are reminded NOT to use easily identifiable information such as date of birth, telephone number or name. Customers are reminded NOT to log into the e-banking through hyperlinks embedded in any emails. Where a customer thinks his/her username with password or mobile phone with mobile token for accessing our mobile banking has been disclosed, is lost or stolen or an unauthorised transaction has been conducted, he/she should be responsible for informing us immediately. Please contact us via our e-banking Customer Services Hotline: (852) 216 95528. Our website address of Internet Banking service are https://ebankhk.spdb.com.cn/hkbank/ or https://ebankhk.spdb.com.cn/pwms/ Customer should be accessed by entering the bank’s website address directly, or using a bookmark to access e-banking services. Never access e-banking services through any hyperlinks or attachments embedded in emails or from unknown websites. Customer should provide a valid mobile phone number, contact address and contact number for notification purpose. If any of these is changed, please notify us timely. Ensure that only your Mobile Token and biometric credentials are stored on your Permitted Mobile Device. Ensure that your Permitted Mobile Device is secure. Ensure that the password or security code allowing access to altering or adding Mobile Token and biometric credentials on your Permitted Mobile Device is protected. Deactivate Mobile Token and Delete the Mobile App from your Permitted Mobile Device if you change or dispose of your Permitted Mobile Device. 3. Major Safety Tips On Using Internet Banking Services (a) Login passwords – Set a password that is difficult to guess and different from the ones for other services. The login password should be changed regularly and should never be stored on computers, mobile phones or placed in plain sight. Keep the security token (if any) provided by us at a safe place. (b) Computers and mobile phones – Protect your computer and mobile phone for logging into your e-banking. Avoid using public computers or public Wi-Fi to access e-banking services. (c) Bank websites – e-banking should be accessed by entering SPDBHK website address directly or using a bookmark. Never access our website or provide your personal information (including your password) through any hyperlinks or attachments embedded in emails or from websites. (d) Login process – Beware of any unusual login screen or process (e.g. a suspicious pop-up window or request for providing additional personal information) and whether anyone is trying to peek at your password. Log out immediately after use. (e) Messages from banks– Check SPDBHK’s SMS messages and other messages in a timely manner and verify your transaction records. Inform us immediately in case of any suspicious situations. We will not ask for any sensitive personal information (including passwords) through phone calls or emails. 4. Major Tips On Protection Of Your Computers And Mobile Phones (a) Passcodes and Protection for Computers and mobile phones – Set a passcode for your mobile phone / password for your computer that is difficult to guess. Activate the auto-lock function. Do not leave your computers and mobile phone unattended when using e-banking or Mobile Banking session. (b) Secure systems and software – Use and update to the latest versions of operating system, security updates and patches, Mobile banking App and browser. Do not jailbreak or root your mobile phone and tablet. (c) Beware of computer viruses – Install and update promptly your security software. Do not browse suspicious websites or click on the hyperlinks and attachments in suspicious emails/SMS messages. Download and upgrade your Apps from official App stores or reliable sources only. (d) Network functions – Disable any wireless network functions (e.g. Wi-Fi, Bluetooth, NFC) not in use. Choose encrypted networks when using Wi-Fi and remove any unnecessary Wi-Fi connection settings. Shanghai Pudong Development Bank Co., Ltd., Hong Kong Branch (incorporated in the PRC with limited liability) Customer Services Hotline: (852) 216 95528 28-Jul-2023

浦发银行香港分行 - 浦发银行官网.pdf

浦发银行香港分行 - 浦发银行官网.pdf