《重庆银行服务收费价格目录》(2023年版).pdf

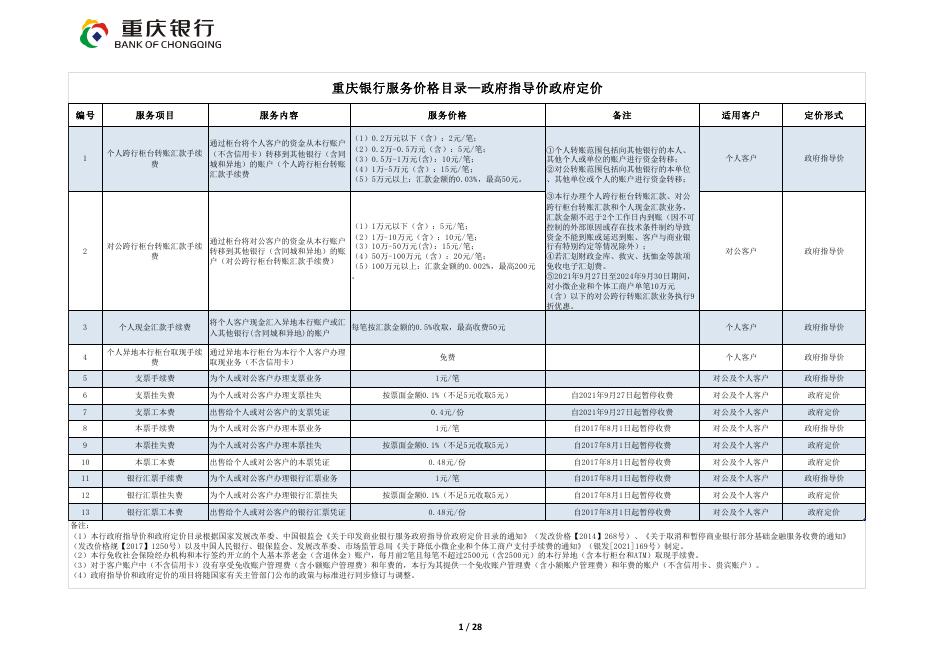

重庆银行服务价格目录—政府指导价政府定价 编号 1 2 3 4 服务项目 服务内容 服务价格 适用客户 定价形式 个人客户 政府指导价 对公客户 政府指导价 个人客户 政府指导价 免费 个人客户 政府指导价 对公及个人客户 政府指导价 (1)0.2万元以下(含):2元/笔; 通过柜台将个人客户的资金从本行账户 (2)0.2万-0.5万元(含):5元/笔; 个人跨行柜台转账汇款手续 (不含信用卡)转移到其他银行(含同 (3)0.5万-1万元(含):10元/笔; 费 城和异地)的账户(个人跨行柜台转账 (4)1万-5万元(含):15元/笔; 汇款手续费 (5)5万元以上:汇款金额的0.03%,最高50元。 (1)1万元以下(含):5元/笔; (2)1万-10万元(含):10元/笔; 通过柜台将对公客户的资金从本行账户 对公跨行柜台转账汇款手续 (3)10万-50万元(含):15元/笔; 转移到其他银行(含同城和异地)的账 费 (4)50万-100万元(含):20元/笔; 户(对公跨行柜台转账汇款手续费) (5)100万元以上:汇款金额的0.002%,最高200元 。 个人现金汇款手续费 备注 ①个人转账范围包括向其他银行的本人、 其他个人或单位的账户进行资金转移; ②对公转账范围包括向其他银行的本单位 、其他单位或个人的账户进行资金转移; ③本行办理个人跨行柜台转账汇款、对公 跨行柜台转账汇款和个人现金汇款业务, 汇款金额不迟于2个工作日内到账(因不可 控制的外部原因或存在技术条件制约导致 资金不能到账或延迟到账、客户与商业银 行有特别约定等情况除外); ④若汇划财政金库、救灾、抚恤金等款项 免收电子汇划费。 ⑤2021年9月27日至2024年9月30日期间, 对小微企业和个体工商户单笔10万元 (含)以下的对公跨行转账汇款业务执行9 折优惠。 将个人客户现金汇入异地本行账户或汇 每笔按汇款金额的0.5%收取,最高收费50元 入其他银行(含同城和异地)的账户 个人异地本行柜台取现手续 通过异地本行柜台为本行个人客户办理 费 取现业务(不含信用卡) 5 支票手续费 为个人或对公客户办理支票业务 1元/笔 6 支票挂失费 为个人或对公客户办理支票挂失 按票面金额0.1%(不足5元收取5元) 自2021年9月27日起暂停收费 对公及个人客户 政府定价 7 支票工本费 出售给个人或对公客户的支票凭证 0.4元/份 自2021年9月27日起暂停收费 对公及个人客户 政府定价 8 本票手续费 为个人或对公客户办理本票业务 1元/笔 自2017年8月1日起暂停收费 对公及个人客户 政府指导价 9 本票挂失费 为个人或对公客户办理本票挂失 按票面金额0.1%(不足5元收取5元) 自2017年8月1日起暂停收费 对公及个人客户 政府定价 10 本票工本费 出售给个人或对公客户的本票凭证 0.48元/份 自2017年8月1日起暂停收费 对公及个人客户 政府定价 11 银行汇票手续费 为个人或对公客户办理银行汇票业务 1元/笔 自2017年8月1日起暂停收费 对公及个人客户 政府指导价 12 银行汇票挂失费 为个人或对公客户办理银行汇票挂失 按票面金额0.1%(不足5元收取5元) 自2017年8月1日起暂停收费 对公及个人客户 政府定价 13 银行汇票工本费 出售给个人或对公客户的银行汇票凭证 0.48元/份 自2017年8月1日起暂停收费 对公及个人客户 政府定价 备注: (1)本行政府指导价和政府定价目录根据国家发展改革委、中国银监会《关于印发商业银行服务政府指导价政府定价目录的通知》(发改价格【2014】268号)、《关于取消和暂停商业银行部分基础金融服务收费的通知》 (发改价格规【2017】1250号)以及中国人民银行、银保监会、发展改革委、市场监管总局《关于降低小微企业和个体工商户支付手续费的通知》(银发[2021]169号)制定。 (2)本行免收社会保险经办机构和本行签约开立的个人基本养老金(含退休金)账户,每月前2笔且每笔不超过2500元(含2500元)的本行异地(含本行柜台和ATM)取现手续费。 (3)对于客户账户中(不含信用卡)没有享受免收账户管理费(含小额账户管理费)和年费的,本行为其提供一个免收账户管理费(含小额账户管理费)和年费的账户(不含信用卡、贵宾账户)。 (4)政府指导价和政府定价的项目将随国家有关主管部门公布的政策与标准进行同步修订与调整。 1 / 28 重庆银行服务价格目录—市场指导价 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 一、个人银行业务 101 长江IC卡工本费 (开卡) 免费 102 长江IC卡工本费 (补换) 5元/张 提供加载芯片的长江卡 个人客户 提供加载芯片的长江卡 个人客户 103 长江卡ATM境内跨行取款手续费 2元/笔 长江卡在境内他行带有“银联”标识的 ATM进行取款 个人客户 104 长江卡ATM境外跨行取款手续费 15元/笔 长江卡在境外他行带有“银联”标识的 ATM进行取款 个人客户 长江卡通过带有“银联”标识的ATM向同 城他行卡办理资金转出 个人客户 长江卡通过带有“银联”标识的ATM向异 地他行卡办理资金转出 个人客户 磁条卡升级补换IC卡免费 1万(含)以下:3元/笔; 1-5万(含):5元/笔 5000元(含)以下:按交易金额1%收取手续费, 106 长江卡ATM跨行异地转账手续费 但不低于5元/笔; 5000-50000(含)元:50元/笔 105 长江卡ATM同城跨行转账手续费 按照基金合同和招募说明书 的约定向投资人收取 在我行办理基金交易业务(认购费、申购 个人客户 费、赎回费、转换费和销售服务费等费 用) 免费 对残疾人、65岁(含)以上老人、低保户免收长 个人客户 江卡书面挂失手续费 109 长江卡书面挂失手续费 5元/笔 受理长江卡卡片挂失业务 110 个人贷款提前还款违约金 按照合同相关约定收取 个体工商户和小微企业主申请的个人经营贷 向借款人违约提前还款提供还款服务 款免收 个人客户 普卡:主卡90元;附属卡45元 金卡:主卡190元;附属卡95元 白金卡:主卡480元;附属卡240元 尊尚白金卡:主卡1800元;附属卡900元 (1)公务金卡、按日分期金卡、安居分 普卡、信用分期普卡免收年费; (2)普卡、金卡免首次有效期年费,首 次有效期后续卡,需刷卡6次且累计金额 达到300元(含)以上免次年年费; (3)白金卡免首年年费,其中抵押方式 办理爱家钱包白金卡在卡片核发12个月 使用信用卡每年需支付的费用 内申请分期金额累计超过2万元(含)或 直接推荐1名新申请人成功办理本业务, 即可减免卡片第二年年费,以此类推; 其他白金卡(含信用方式办理爱家钱包 白金卡)刷卡9次且累计金额达到500元 (含)以上免次年年费。 个人客户 107 代理基金业务 108 对残疾人、65岁(含)以上老人、 低保户长江卡书面挂失手续费 个人客户 二、信用卡业务 201 信用卡年费 2 / 28 “有效期”特指首次申请信 用卡的卡片有效期 编号 服务项目 服务价格 优惠措施 服务内容 申请优先处理发卡并用快递寄送卡片 适用客户 202 快速发卡手续费 100元/卡 203 补制卡片费 手续费25元/卡,加急45元/卡 白金卡、公务金卡免费 因遗失等原因,向发卡行申请补制卡片所 个人客户 产生的费用 204 挂失手续费 50元/卡(不含补卡费用) 金卡、白金卡免费 因遗失等原因,向发卡行申请挂失,发卡 个人客户 行做出相应安全处理所产生的费用 205 违约金 按每期最低还款额未还部分的5%收取,最低收费 为20元 不按还款期限归还欠款,加收未还款项一 个人客户 定比例的金额 206 预借现金手续费 本行取现无手续费,跨行取现每笔按1%收取,最 低10元 使用信用卡透支取现所产生的费用 个人客户 207 调阅消费签购单费 国内:20元/笔,国外:40元/笔 调阅信用卡消费时所签字确认的签购单 个人客户 208 溢缴款提取手续费 本行提取无手续费,跨行提取交易金额的0.5%, 公务金卡境内免费 最低5元/笔 提取多缴的存放在信用卡账户内的资金 个人客户 209 互动短信费(信用卡) 3元/季 发生金额在300元及以上的动户交易时发 送短信提示 个人客户 210 境外使用业务费 取现收取1.5%的汇兑手续费,除此之外,预借现 金境外取现手续费:交易金额的3%,最低30元/ 笔; 溢缴款境外取现手续费:交易金额的5‰,最低5 元/笔 境外使用预借现金服务 个人客户 211 分期提前还款违约金 按照协议相关约定收取 向分期客户提前还款提供还款服务 个人客户 212 分期撤销手续费 20元/笔 撤销分期产生的费用 个人客户 301 理财产品投资管理 按协议价格收取 根据理财产品协议或说明书约定为客户提 供专业化的资产管理投资运作服务,按理 理财客户 财产品协议或说明书规定收取 302 理财产品销售 按协议价格收取 向客户销售理财产品或为客户办理理财产 品认购、申购、赎回等交易,按理财产品 理财客户 协议或说明书规定收取相应服务费 303 信托保管手续费 按照协议,以质定价 信托发起人委托银行保管资产,收取保管 同业客户 费 白金卡国内调阅免费 现行免费 个人客户 三、金融同业业务 3 / 28 备注 优惠期间:2023年1月1日2025年6月30日 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 四、公司银行业务 为客户办理银行承兑汇票承兑 业务 对公客户 根据企业需要提供各类金融咨询服务 对公客户、同 业客户 按不低于银团贷款总额0.25%的比例一次性支付 银团组织安排及贷款方案设计 (安排费) 对公客户 404 银团贷款 按不低于未用余额0.2%的比例每年按银团贷款协 议约定方式收取 未使用银团贷款额度占用 (承诺费) 对公客户 405 银团贷款 根据代理行的工作量按年支付 归集银团资金并代表银团对资金 进行监管及贷后管理(代理费) 对公客户 406 委托贷款 贷款金额<1亿元:年手续费率≥1.5‰; 贷款金额≥1亿元:年手续费率≥1‰; 以上收费标准中单笔手续费不足1000元的,按年 手续费1000元/笔收取; 手续费率另有约定的按约定价格收取 按委托人要求办理相关贷款手续及资金监 对公客户 管(代理一般贷款) 407 委托贷款 按协议价格收取 按委托人要求办理相关贷款手续及资金监 管(代理政策性银行贷款、外国政府转贷 对公客户 款、买方信贷转贷款) 408 敞口保函 非融资类敞口保函应根据保函风险度按年收取保 函金额不低于1‰的担保费; 开立各类非融资性敞口保函的敞口额度担 对公客户 保 409 敞口保函 融资类敞口保函应根据保函风险度按年收取保函 敞口金额不低于2%的担保费 开立各类融资性敞口保函的敞口额度担保 对公客户 410 敞口保函 每笔敞口保函另收保函金额1‰的手续费,最低不 得低于100元/笔 开立各类敞口保函 对公客户 411 全额保证金保函 全额保证金保函按年收取保函金额1‰-3‰的手续 费; 每笔保函手续费不低于100元/笔 开立各类全额保证金保函 对公客户 401 银行承兑汇票 银行承兑汇票手续费:按票面金额0.05% 402 对公财务顾问费 按照协议,以质定价 403 银团贷款 412 贷款承诺函 413 监管业务 不低于1000元/笔 小微客户免费 对符合工信部、国家统计局、国家发改 委、财政部《关于印发中小企业划型标 准规定的通知》(工信部联企业 [2011]300号)规定的小型和微型企 业,予以免收。 开立《信贷证明》、《贷款承诺函》、《 对公客户 贷款意向书》的手续办理 按委托人要求,符合政策法规规定,我行 作为资金监管(或担任受托管理人及债权 对公客户及同 管理人)行提供的基金、债券、资管计划 业客户 及其他资金监管服务(手续费) 按照协议,以质定价,原则上手续费率≤2%/年 4 / 28 以存单、凭证式国债全额质 押开具保函的收费标准参照 全额保证金收费标准执行。 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 按照协议,以质定价 发行人兑付时,按约定支付手续费;发行 人发行债券,我行作为承销商提供债券承 对公客户 销服务,发行人按照协议约定支付承销商 手续费 501 国内信用证 国内信用证开证手续费:按金额1.5‰收取,最低 100元 国内信用证开证手续费 对公客户 502 国内信用证 国内信用证修改费:100元/笔 国内信用证修改费 对公客户 增资修改的,对增资部分按开 证手续费标准收取 503 国内信用证 国内信用证延期付款确认费:按 金额1‰收取,最低100元(季) 国内信用证延期付款确认费 对公客户 不足1个季度按1个季度收 取,低风险项下业务可减额 或免收 504 国内信用证 国内信用证不符点费:500元/笔 国内信用证不符点费 对公客户 一般扣收受益人 505 国内信用证 国内信用证通知/修改通知费: 50元/笔 国内信用证通知/修改通知费 对公客户 506 国内信用证 国内信用证议付/委托收款审单费:按金额1‰收 取,最低100元 国内信用证议付/委托收款审单费 对公客户 507 国内保理业务 国内卖方保理、国内再保理、债权单融资业务按 不低于应收账款金额的0.125%收取。 应收帐款的管理及催收(管理费) 对公客户 508 福费廷 按照协议收取费用 福费廷手续费 对公客户 509 国内信用证代付 按照协议收取费用 国内信用证代付手续费 对公客户 510 应收账款质押 不低于授信金额的0.5% 应收帐款的管理及催收(管理费) 对公客户 511 汇款 汇出汇款(对公)手续费:按金额1‰收取,最低 50元,最高1000元 汇出汇款手续费(对公) 对公客户 512 汇款 汇出汇款(对私)手续费:按金额1‰收取,最低 20元,最高500元 汇出汇款手续费(对私) 对私客户 513 汇款 修改:100元/笔 汇出汇款修改费 所有客户 514 汇款 受益人退汇:按汇出汇款收费 受益人退汇 所有客户 414 债券兑付及承销手续费 五、国际业务 515 汇款 非受益人退汇:10美元/笔 非受益人退汇 所有客户 516 托收 光票托收:按金额1‰收取,最低50元,最高1000 元 光票托收手续费 对公客户 517 托收 跟单托收:按金额1‰收取, 最低100元,最高2000元 跟单托收手续费 对公客户 5 / 28 含电报费 从退汇本金中扣收,如为其 他币种,分别按EUR10/笔, GBP10/笔,HKD100/笔, JPY1000/笔等收取 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 518 托收 进口代收:按金额1‰收取,最低100元,最高 2000元 进口代收手续费 对公客户 519 托收 跟单托收/代收修改:100元/笔 跟单托收/代收修改费 对公客户 520 托收 跟单托收/代收退单:200元/笔 跟单托收/代收退单费 对公客户 521 信用证 出口信用证通知/转递:200元/笔 出口信用证通知/转递费 对公客户 522 信用证 出口信用证修改通知/注销: 100元/笔 出口信用证修改通知/注销 对公客户 523 信用证 出口信用证转让:按金额1‰收取,最低300元, 最高2000元 出口信用证转让 对公客户 524 信用证 出口信用证议付/验单:按金额1.25‰收取,最低 200元 出口信用证议付/验单 对公客户 525 信用证 进口信用证开证手续费:按金额1.5‰收取,最低 300元 进口信用证开证手续费 对公客户 备注 如在我行办理议付,可在议 付手续费中抵扣该费用;含 保函的通知或转递 526 信用证 进口信用证修改手续费:100元/笔,境外客户承 担时USD40/笔 进口信用证修改手续费 对公客户 如为其他币种,分别按 EUR40/笔、GBP40/笔、 HKD400/笔,JPY4000/笔等 收取;增资修改的,对增资 部分按开证手续费标准收取 527 信用证 信用证承兑费:按金额1‰收取,最低100元 (季) 信用证承兑费 对公客户 不足1个季度按1个季度收 取,低风险项下业务可减额 或免收 对公客户 一般扣收受益人,如为其他 币种,分别按EUR60/笔、 GBP60/笔、CNY600/笔、 HKD600/笔、JPY6000/笔或 按当日汇率折算收取 对公客户 一般扣收受益人,如为其他 币种,分别按EUR10/笔、 GBP10/笔、CNY100/笔、 HKD100/笔、JPY1000/笔或 按当日汇率折算收取 对公客户 一般扣收受益人,如为其他 币种,分别按EUR35/55、 GBP35/55、CNY350/550、 HKD350/550、 JPY3500/5500等或按当日汇 率折算收取 528 信用证 529 信用证 530 信用证 不符点费:USD60/笔 不符点费 无副本费:USD10/笔 无副本费 付款电报费:USD35/笔(即期)、USD55/笔(远 期) 付款电报费 6 / 28 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 531 信用证 银行抬头提单背书:100元/笔 银行抬头提单背书 对公客户 532 信用证 进口信用证退单:200元/笔 进口信用证退单 对公客户 533 信用证 进口信用证提货担保:按金额0.5‰/季收取,最 低300元(季) 进口信用证提货担保 对公客户 534 信用证 按照协议,最低按开证金额的0.3‰收取,代开证 修改,涉及金额增加的,按开立收费标准收取, 不涉及金额增加的,按30元/笔收取;代开证承兑 200元/笔收取 代理同业开立信用证手续费 对公客户及同 业客户 535 保函 付款保函:按金额1.5‰/季收取,最低500元(季) 付款保函开立手续费 对公客户 536 保函 投标保函:按金额0.5‰/季收取,最低500元(季) 投标保函开立手续费 对公客户 537 保函 履约保函:按金额1‰/季收取,最低500元(季) 履约保函开立手续费 对公客户 538 保函 预付款保函:按金额1‰/季收取,最低500元(季) 预付款保函开立手续费 对公客户 539 保函 融资性保函:按金额2‰-6‰/季收取,最低1000 元(季) 融资性保函手续费 对公客户 540 保函 其他类保函:按金额0.5‰-2‰/季收取,最低 500元(季) 其他类保函开立手续费 对公客户 备注 不足1个季度按1个季度收 取,全额保证金办理时300元 /笔 不足1个季度按1个季度收 取,具体业务收费经业务管 理部门审批后,按协议收取 如为其他币种,分别按 EUR40/笔、GBP40/笔、 HKD400/笔,JPY4000/笔等 收取;增资修改的,对增资 部分按开立保函手续费标准 收取 541 保函 保函修改:100元/笔, 境外客户承担时USD40/笔 保函修改费 对公客户 542 保函 保函项下索赔:按金额0.625‰收取,最低500元 保函项下索赔手续费 对公客户 543 保函 按照协议,不低于担保金额2‰/年,最低500元/ 季,最高不超过担保金额的2.4%/年 受托转开保函手续费 对公客户及同 不足一个季度的按一个季度 业客户 收取。仅针对跨境担保业务 544 其他国际业务 80元/笔 境内汇款电报费 所有客户 545 其他国际业务 80元/笔(港澳)120元/笔(远洋) 境外汇款电报费 所有客户 546 其他国际业务 200元/笔 进口代收付款电报费 所有客户 547 其他国际业务 200元/笔 开立信用证/保函电报费 对公客户 7 / 28 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 对公客户 如为其他币种,分别按 EUR10/笔、GBP10/笔、 HKD100/笔,JPY1000/笔等 收取 往来函电费 所有客户 如为其他币种,分别按 EUR10/笔、GBP10/笔、 HKD100/笔,JPY1000/笔或 按当日汇率折算收取 100元/笔 核印、押 对公客户 按照协议,以质定价,原则上 不高于融资金额1%/每年 跨境融资安排服务安排费 对公客户 601 银行承兑汇票业务 银行承兑汇票查询费:30元/笔 跨行办理银行承兑汇票票据信息查询 所有客户 602 储蓄存单、存折挂失手续费 免费 办理储蓄存折(单)书面挂失 个人客户 603 储蓄账户管理年费 免费 储蓄账户管理 个人客户 604 账户服务 开户:50元/户/次 开户 对公客户 优惠期间:2021年9月27日2024年9月30日 605 账户服务 账户信息变更:10元/次/户 账户信息变更 对公客户 验资账户转为基本存款账户 时不收取 606 账户服务 补制回单:10元/次/份 补制回单 对公客户 “份”应指发生该业务的行 为,按次计量 607 账户服务 补制对账单:当年10元/次/份,跨年20元/次/份 补制对账单 对公客户 608 账户服务 印鉴变更:10元/次/户 印鉴变更 对公客户 609 账户服务 印鉴挂失:50元/次/户 印鉴挂失 对公客户 610 结算凭证工本费 银行汇(本)票申请书:免费 电汇凭证:2.5元/本 信汇凭证:2.5元/本 清分机进账单:5.5元/本 普通进账单:2元/本 贴现凭证:3元/本 托收凭证:2.5元/本 拒绝付款理由书:2.5元/本 现金进账单:2元/本 商业承兑汇票:12元/本 银行承兑汇票:12元/本 空白重要凭证领用单:2.5元/本 出售结算凭证收取工本费 所有客户 548 其他国际业务 100元/笔 549 其他国际业务 100元/笔, 境外客户承担时USD15/笔 550 其他国际业务 551 其他国际业务 信用证/保函修改电报费 六、结算业务 小微企业客户及个体工商户开立账户免 收开户手续费 8 / 28 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 托收承付、委托收款按往返 对公及个人客 邮程收费,如附寄的单证过 户 多,按邮局规定标准加收超 重邮费 611 委托收款和托收承付 手续费:1.00元/笔; 邮费(含特快专递):按邮政部门规定的收费标 准收取 为客户办理委托收款和托收承付业务 612 人行通(重庆) (1)个人跨行转账: 汇划金额≤0.2万元:2元; 汇划金额0.2-5万元(含):3元; 汇划金额5-10万元(含):5元; 汇划金额10-50万元(含):10元; 汇划金额50-100万元(含):15元; 汇划金额>100万元:按汇划金额的万分之零点二 对小微企业和个体工商户单笔10万元 收取,最高不超过50元 (2)对公跨行转账: (含)以下的对公跨行转账汇款业务执 汇划金额≤5万元:3元; 行9折优惠 汇划金额5-10万元(含):5元; 汇划金额10-50万元(含):10元; 汇划金额50-100万元(含):15元; 汇划金额>100万元:按汇划金额的万分之零点二 收取,最高不超过200元 (3)个人现金汇款: 每笔按汇款金额的0.4%收取,最高50元 (1)主城区支行,对公客户 使用转帐支票免收费;对公 客户使用电汇凭证,按照人 行标准执行; (2)远郊区县支行按当地人 行标准执行; 限于通过重庆支付信息综合服务系统办理 对公及个人客 (3)此业务适用于重庆辖 的汇款业务 户 内,异地分行同类业务按当 地人民银行规定执行 (4)针对小微企业和个体工 商户对公跨行转账汇款业务 的优惠政策,优惠期间为 2021年9月27日至2024年9月 30日。 613 单位存款证明 200元/份 单位存款证明 对公客户 614 单位贷款证明 100元/份 单位贷款证明 对公客户 615 结算纪律证明 200元/份 结算纪律证明 对公客户 616 银行询证函 200元/份 617 个人存款证明 20元/份 618 特约商户结算手续费 按照合同相关约定收取 对符合工信部、国家统计局、国家发改 委、财政部《关于印发中小企业划型标 准规定的通知》(工信部联企业〔2011 提供询证函回函服务 〕300号)规定的小型、微型企业和个体 工商户,取消银行询证函收费。 个人存款证明 对公客户 个人客户 1.2021年9月30日-2024年9月30日,对特 约商户银行卡刷卡手续费实施优惠,优 惠折扣为:标准类商户借记卡刷卡手续 费实行9折优惠且封顶值维持不变、优惠 为特约商户开展收单业务,提供资金结算 所有客户 类商户实行7.8折优惠。 服务 2.2022年1月1日-2022年12月31日,为 特约商户提供手续费减免优惠,即单个 商户每自然月免收最高1000元二维码交 易手续费。 9 / 28 减免优惠自2022年5月1日生 效 1.银行卡刷卡手续费优惠期 间:2021年9月30日-2024年 9月30日; 2.二维码收单交易手续费优 惠期间:2022年1月1日2022年12月31日 编号 服务项目 服务价格 优惠措施 服务内容 适用客户 备注 七、互联网业务 个人客户 优惠期间:2023年1月1日2025年6月30日 Usbkey介质:35元/个 办理以下任一业务的客户均可免费领取 UK介质: (1)签约开通手机银行; (2)购买10万元(含)理财产品; 介质工本费 (3)签约开通600元/月以上(含)基金 定投; (4)重庆银行持卡客户办理信用卡分期 业务一笔以上(含) 个人客户 优惠期间:2023年1月1日2025年6月30日 703 手机银行OTP动态令牌介质 OTP动态令牌:16元/个 现行免费 介质工本费 个人客户 优惠期间:2023年1月1日2025年6月30日 704 个人网银跨行转账手续费 普通转账:2元/笔 实时转账:3元/笔 现行免费 人民币结算手续费 个人客户 优惠期间:2023年1月1日2025年6月30日 705 手机银行跨行转账手续费 普通转账:2元/笔 实时转账:3元/笔 现行免费 人民币结算手续费 个人客户 优惠期间:2023年1月1日2025年6月30日 706 企业网银数字证书 200元 企业版网银:现行优惠价为100元/年 小微企业版网银:0元/年 CFCA证书服务费 对公客户 优惠截止日期:2024年9月 30日 707 企业网银Usbkey介质 Usbkey介质(一代):30元/个 介质工本费 对公客户 自2021年9月30日起,小微 企业和个体工商户不高于成 本价收取,优惠期间:2021 年9月30日-2024年9月30日 708 企业网银Usbkey介质 Usbkey介质(二代):35元/个 小微企业版网银:0元/年 介质工本费 对公客户 自2021年9月30日起,小微 企业和个体工商户不高于成 本价收取,优惠期间:2021 年9月30日-2024年9月30日 企业网银跨行转账手续费 (到账时间:普通、次日) 5万(含)以下:2元/笔 5万以上:5元/笔 对小微企业和个体工商户单笔10万元 (含)以下的对公跨行转账汇款业务执 行9折优惠 人民币结算手续费 对公客户 优惠期间:2021年9月27日2024年9月30日 企业网银跨行转账手续费 (到账时间:实时) 1万元以下(含):5元; 1万元-10万元(含):10元; 10万元-50万元(含):15元; 50万元-100万元(含):20元; 100万元以上:转账金额0.002%, 最高不超过200元 对小微企业和个体工商户单笔10万元 (含)以下的对公跨行转账汇款业务执 行9折优惠 人民币结算手续费 对公客户 优惠期间:2021年9月27日2024年9月30日 701 个人网银数字证书 5元/张 免费 702 个人网银Usbkey介质 709 710 CFCA证书服务费 八、本年新增或提高价格的服务收费项目 备注: (1)针对小微企业及个体工商户支付手续费的优惠按照中国人民银行、银保监会、发展改革委、市场监管总局《关于降低小微企业和个体工商户支付手续费的通知》(银发[2021]169号)执行。其中,小微企业是指符合工 业和信息化部《中小企业划型标准规定》的小型、微型企业,个体工商户是指在市场监管部门登记的个体工商户。 (2)结售汇、代客套汇买卖按照我行业务系统挂牌汇率或单笔大额询价汇率(现汇买入价、现钞买入价、现汇/现钞卖出价)执行。客户因业务需求,将外币存款(现钞存款、现汇存款)或外币现钞、外币汇款等,进行钞 汇性质的转换时,现汇户取现钞按交易时汇买钞卖价折算(包括同种货币),现钞户取外币现钞,同种货币免费,不同币种按交易时牌价折算,现钞兑现汇按交易时钞买汇卖价折算(包括同种货币);邮寄费根据中国邮政 或者快递公司报价收取;在各项业务中发生的应由客户承担的他行费用按实收取;与同业之间的中间业务按照协议收取费用;上述外币费用均可根据交易日汇率折算后以其他币种收取费用。 (3)同城业务覆盖的区域范围为地级市行政区划,同一直辖市、省会城市、计划单列市列入同城范畴。 10 / 28 (4)投诉邮件地址重庆市江北区永平门街6号资产负债管理部;重庆银行全国客户服务热线956023;消费者投诉举报专线电话12315;“不规范经营”专线投诉电话023-60330784。 中国银行保险监督委员会 中国银行保险监督委员会 信贷业务七不准 服务收费四公开 不准以贷转存 收费项目公开 不准存贷挂钩 服务质价公开 不准以贷收费 效用功能公开 不准浮利分费 优惠政策公开 不准借贷搭售 不准一浮到顶 不转转嫁成本 11 / 28 一、 “七不准”内容 (一)不得以贷转存 信贷业务应坚持实贷实付和受托支付原则,将贷款资金足额直接支付给借款人的交易对手,不得强制设 定条款或协商约定将部分贷款转为存款。 (二)不得存贷挂钩 贷款业务和存款业务应严格分离,不得以存款作为审批和发放贷款的前提条件。 (三)不得以贷收费 不得借发放贷款或以其他方式提供融资之机,要求客户接受不合理中间业务或其他金融服务而收取费用。 (四)不得浮利分费 要遵循利费分离原则,严格区分收息和收费业务,不得将利息分解为费用收取,严禁变相提高利率。 (五)不得借贷搭售 不得在发放贷款或以其他方式提供融资时强制捆绑、搭售理财、保险、基金等金融产品。 (六)不得一浮到顶 贷款定价应充分反映资金成本、风险成本和管理成本,不得笼统将贷款利率上浮至最高限额。 (七)不得转嫁成本 贷款业务及其他服务中产生的尽职调查、押品评估等相关成本,不得将经营成本以费用形式转嫁给客户。 12 / 28 二、 “四公开”内容 (一)收费项目公开。由总行统一制定收费价目名录和价格,同一收费项目必须使用统一收费项 目名称、内容描述、客户界定等要素,任何分支机构不得自行制定和调整收费项目名称等要素。 (二)服务质价公开。服务收费应合乎质价相符原则,不得对未给客户提供实质性服务、未给客 户带来实质性收益、未给客户提升实质性效率的产品和服务收取费用。 (三)效用功能公开。服务价格应遵循公开透明原则,各项服务必须“明码标价”,充分履行告 知义务,使客户明确了解服务内容、方式、功能、效果,以及对应的收费标准,确保客户了解充分信 息,自主选择。 (四)优惠政策公开。对特定对象坚持服务优惠和减费让利原则,明确界定小微企业、“三农”、 弱势群体、社会公益等领域相关金融服务的优惠对象范围,公布优惠政策、优惠方式和具体优惠额度, 切实体现扶小助弱的商业道德。 13 / 28 Price List for Services Offered by Bank of Chongqing - Government pricing & Government-guided price No. 1 Services Service Description Transfer of individual customer's money from Charges for account (excluding credit inter-bank card) with our Bank to other transfer and banks (including local and remittance by non-local banks) at bank individual counter (charges for intercustomers at bank bank transfer and remittance counter by individual customers at bank counter) Service Price Remarks Applicable to Nature of Pricing ①Personal transfer supports RMB 2 for transaction of transferring funds to the applying RMB2,000 or less; RMB 5 for individuals account with other banks, transaction of RMB2,000 accounts of other person or company with RMB5,000 (inclusive); RMB10 for other banks. transaction of RMB5,000 ②Corporate transfer supports Individual customer RMB10,000 (inclusive); RMB15 for transferring funds to the applying transaction of RMB10,000 - RMB company’s account with other banks, 50,000 (inclusive); and 0.03% of accounts of other company or person with the remittance amount (RMB50 in other banks. maximum) for transaction above ③Our Bank handles counter-based interRMB 50,000 bank transfer and remittance for Government-guided price personal customers, counter-based interbank transfer and remittance for corporate customers, and cash remittance for personal customers, and the RMB 5 for each transaction of remittance amount should be credited RMB 10,000 or below; RMB 10 for within 2 business days (except in the Transfer the funds of each transaction of RMB 10,000 - cases where the funds cannot be credited corporate customer from an RMB 100,000 (inclusive); RMB 15 or are delayed in being credited, or account with Bank of for each transaction of RMB where the customer and the commercial Chongqing to an account with 100,000 - RMB 500,000 bank have agreed otherwise). other banks (including local (inclusive); RMB 20 for each ④Remittance fee is exempted for and non-local banks) transaction of RMB 500,000 - RMB financial treasury, disaster relief and (counter-based inter-bank 1 million (inclusive); and pension for the disabled or the family remittance fee for corporate 0.002% of remittance amount for of the deceased. customers) each transaction above RMB 1 ⑤Small and micro enterprises and million, maximum service price individual businesses will receive a 10% is RMB 200 discount for inter-bank transfer and remittance of less than RMB100,000, from September 27,2021 to September 30,2024. 2 Counter-based inter-bank remittance fee for corporate customers 3 Charges for cash remittance by individual customer Remittance of individual customer's cash to intrabank non-local account or account with other banks (including local and nonlocal banks) 4 Charges for personal cash withdrawal at non-local counters of our Bank 5 Charges for check Corporate customer Government-guided price 0.5% of the remittance amount of and at most RMB 50 for each transaction Individual customer Government-guided price Cash withdrawal service for our individual customers at non-local counters of our Bank(excluding credit card) Free of charge Individual customer Government-guided price Affairs regarding check business for personal or corporate customers RMB 1/transaction All customers Government-guided price 14 / 28 No. Services Service Description Service Price Remarks Applicable to Nature of Pricing 6 Fees for report of losing check Affairs regarding report of losing check by personal or corporate customers 0.1% of face value and at least RMB5 Free of charge since September 27,2021 All customers Government pricing 7 Fees for creation Check voucher sold to of vouchers sold personal or corporate to customers customers RMB 0.4 each Free of charge since September 27,2021 All customers Government pricing RMB 1/transaction Free of charge since August 1,2017 All customers Government-guided price 0.1% of face value and at least RMB5 Free of charge since August 1,2017 All customers Government pricing 8 9 Bank note business for personal or corporate customers Affairs regarding report of Charges regarding losing bank note with report of losing respect to personal or bank note corporate customers Charges for promissory note 10 Fees for creation Bank note vouchers sold to of vouchers sold personal or corporate to customers customers RMB 0.48 each Free of charge since August 1,2017 All customers Government pricing 11 Bank draft business for Charges regarding personal or corporate bank draft customers RMB 1/transaction Free of charge since August 1,2017 All customers Government-guided price 0.1% of face value and at least RMB5 Free of charge since August 1,2017 All customers Government pricing RMB 0.48 each Free of charge since August 1,2017 All customers Government pricing Affairs regarding report of Charges regarding losing bank draft with 12 report of losing respect to personal or bank draft corporate customers 13 Fees for creation Bank draft vouchers sold to of vouchers sold personal or corporate to customers customers Notes: 1.The list of government-guided price and government pricing shall be formulated in acoordance with the "Notice of the National Development and Reform Commission and the China Banking Regulatory Commission on Issuing the Catalog of Government-guided Prices and Government Pricing for Commercial Banking Services(Fa Gai Jia Ge [2014] No. 268)","Notice on Cancellation and Suspension of Fees for Some Basic Financial Services of Commercial Banks(Fa Gai Jia Ge Gui[2017] No.1250)" and "Notice on Reducing Service Charges for Small and Micro Enterprises and Individual Businesses(Yin Fa[2021] NO.169)" 2.For individual basic pension (including retirement pension) accounts opened according to the contract between the social insurance agency and the Bank of Chongqing, shall be free of charge for the intra-bank non-local cash withdrawal (RMB 2500 or less per traction) fees for the first 2 tractions each month (including counters and ATMs). 3.For customers whose account(excluding credit cards) does not enjoy the exemption of account management fees(including petty account management fees), one account(excluding creadit cards, VIP accounts) free of charge for account management (including petty account management fees) shall be provided. 4.The government-guided price and government pricing items will be revised and adjusted simultaneously with the policies and standards announced by the relevant national authorities. 15 / 28 Price List for Services Offered by Bank of Chongqing - Market-adjusted price No. Services Service Price Preferential Terms Service Description Applicable to Provision of Yangtze River Card with IC chip Individual customer Free of charge for replacement of magnetic Provision of Yangtze River Card with strip card IC chip Individual customer (I) Personal banking 101 102 Fees for making Yangtze Free of charge River IC Card (care opening) Fees for making Yangtze River IC Card (care replacement) RMB 5 per card 103 Charges for inter-bank domestic withdrawal with RMB2/transaction Yangtze River Card at ATMs Inter-bank domestic withdrawal with Yangtze River Card at ATMs marked with "UnionPay" Individual customer 104 Charges for inter-bank overseas withdrawal with RMB15/transaction Yangtze River Card at ATMs Inter-bank overseas withdrawal with Yangtze River Card at ATMs marked with" UnionPay Individual customer A transfer of no more than RMB10,000 is Charges for inter-bank samecharged at RMB3 each; while a transfer of 105 city transfer with Yangtze RMB10,000-50,000 (inclusive) is charged River Card at ATMs at RMB5 each Outward money transfer with Yangtze River Card at ATMs marked with "UnionPay" to bank card issued by other banks in the same city Individual customer A transfer of no more than RMB5,000 is Charges for inter-bank charged at 1% of the transaction amount 106 nonlocal transfer with and at least RMB5 each; while a transfer Yangtze River Card at ATMs of RMB5,000-50,000 (inclusive) is charged at RMB50 each. Outward money transfer with Yangtze River Card at ATMs marked with "UnionPay" to bank card issued by other banks in other cities Individual customer Fund transactions at our Bank (fees for subscription, subsequent subscription, redemption and switching of fund units and fund sales charges) Individual customer Waiver of charges regarding written report of losing Yangtze River Card by the disabled, people aged 65 and above and people receiving minimum living guarantee Individual customer Affairs regarding written report of losing Yangtze River Card Individual customer 107 Agency for funds Charge on investors pursuant to fund contract and prospectus Charges regarding written report of losing Yangtze River Card by the disabled, people 108 Free of charge aged 65 and above and people receiving minimum living guarantee Charges regarding written 109 report of losing Yangtze River RMB 5/transaction Card 16 / 28 Remarks No. 110 Services Damages for breach of contract due to early repayment of individual consumption loans Service Price Service Description Applicable to Repayment for borrowers who repay loans earlier than the contractual schedule Individual customer (1) Free of charge for official golden card, golden card for day instalment, classic card of "Anjufen" and classic card for credit installment; (2) Classic card and golden card are exempt from annual fee within the first validity period. If renewed and used more Classic card: Primary card RMB than 6 times with accumulated amount RMB 300, the 90;Supplementary card RMB 45; following annual fee will not be charged. Gold card: Primary card RMB (3) Platimum card for mortgage will not be charged at the Annual fees payable for using credit 190;Supplementary card RMB 95; first time. The annual fee for the second year of “ Platinum card: Primary card RMB card Aijiaqianbao” platinum card can be reduced if the 480;Supplementary card RMB 240; accumulated installment amount exceeds RMB 20,000 Priority platimum card:Primary card (inclusive) or a new applicant is directly recommended to RMB 1800;Supplementary card RMB 900 successfully handle the installment business within 12 months after the card issued,and so on. The annual fee for the next year of other platinum card will be reduced if used more than 9 times with accumulated amount RMB 500(inclusive). Individual customer Prioritized handling of card application and delivery of the card by express mail Individual customer Individual customer Charge according to the contract Preferential Terms Individual business loans applied for by small and micro enterprises and individual businesses are exempted Remarks (II) Credit card business 201 Annual fee of creadit card 202 Fees for quick card issuance RMB 100/card 203 Fees for card remaking Charges: RMB25/card; Urgent card making: RMB45/card; 204 Fees for card loss RMB50/card (excluding fees for card replacement); Free of charge for platinum card and official golden card Fees arising from the application with the card issuing bank for replaced card due to loss and other reasons Free of charge for gold card and platinum card Fees arising from security procedures taken by the card issuing bank in response to report of card loss due to loss and other reasons Individual customer If any repayment is overdue, a compensation proportionate to unpaid amount will be charged Individual customer Fees arising from overdraft using credit card Individual customer Access to signed consumption receipts with respect to consumption with credit card Individual customer 205 5% of unpaid part of the minimum payable Compensation on breach of amount and at least RMB20 for each contract installment 206 Charges for cash advance Intra-bank cash withdrawal is free of charge, while inter-bank cash withdrawal is charged at 1% of and at least RMB 10 for each transaction 207 Charge for access to signed Domestic: RMB 20/transaction; overseas: Free of charge for platinum card consumption receipts RMB 40/transaction 17 / 28 "validity period" means the period of validity of the card firstly applied No. Services Service Price Preferential Terms Service Description Applicable to 208 Fee for withdrawal of overpayment Intra-bank withdrawal is free of charge, while inter-bank withdrawal is charged at Free of charge for official golden card interiorly 0.5% and at least RMB 5 for each transaction Withdrawal of overpayment deposited in the credit card account Individual customer 209 Fees for interactive SMS (Credit Card) RMB 3 per season A short message will be sent for any transaction of RMB 300 and above Individual customer 210 Operating expenses for overseas use The exchaged fee is 1.5% of the transaction amount. In addition, the cash withdrawal is charged at 3% of the transaction amount and at least RMB 30/transaction. Overpayment cash withdrawal is charged at 5% of the transaction amount and at least RMB 5/transaction. Cash advance service overseas Individual customer 211 Charges for intallment prepayment service Pricing according to agreement Installment prepayment service Individual customer Cancel expenses incurred by installments Individual customer Fees will be charged for professional services of investment management according to the agreement or specification Customers for wealth management Customers for wealth management Free of charge at present 212 Installments cancellation fee RMB 20 per pen (III) Treasury business Investment management of 301 Pricing according to agreement wealth management products 302 Charges for sale of wealth management products Pricing according to agreement Fees will be charged according to the agreement or specification when selling wealth management products and dealing with transactions for customers such as subscription and redemption 303 Charge for trust deposit Pricing according to agreement and based on product nature Fees will be charged by us as depository of trust deposited by trust sponsor 18 / 28 Interbank clients Remarks Preferential from January 1, 2023 to June 30, 2025 No. Services Service Price Preferential Terms Service Description Applicable to 0.05% of face value Charges for acceptance requested by acceptance applicant Corporate customer Pricing according to agreement and based Free of charge for micro and small enterprises on product nature Provide consultancy services regarding finance according to requirements of the enterprise Corporate customer、 Trade customer (IV) Corporate banking 401 Bank acceptance 402 Charges for corporate financial consultancy 403 Syndicated loans No less than 0.25% of the total syndicated loan in a lump sum Organization and arrangement of syndicate and design of loan extension scheme(arrangement fee) Corporate customer 404 Syndicated loans No less than 0.2% of unused commitment in the way agreed in syndicated loan agreement on annual basis Occupancy of unused commitment to syndicated loans(commitment fee) Corporate customer Syndicated loans Payable on a yearly basis based on the workload of the agent bank Pooling of capital from syndicate and supervision and post-loan management over the capital on behalf of the syndicate(agency fee) Corporate customer Entrusted loan extension Loan< RMB 100 million:annual charge≥ 1.5‰; Loan≥ RMB 100 million:annual charge≥ 1‰; Annual charge will be RMB 1,000/transaction if the charge for a single transaction is below RMB 1,000 pursuant to the above standards; Charge will be accrued separately, if it is otherwise agreed Affairs regarding loan extension procedures and capital supervision under request of the trustor (agency for general loans) Corporate customer At agreed charges Affairs regarding loan extension procedures and capital supervision under request of the truster(agency for policy bank loans, foreign government loans under on-lending scheme, loans based on buyer's credit under on-lending scheme) Corporate customer The guarantee for the exposure of non-financing letter of guarantee. Corporate customer The guarantee for the exposure of financing letter of guarantee Corporate customer Issuing letter of guarantee with exposure Corporate customer 405 406 407 Entrusted loan extension 408 Letter of guarantee with exposure 409 Letter of guarantee with exposure 410 Letter of guarantee with exposure Annual guarantee charges at no less than 1‰ of the amount of letter of guarantee will be accrued for non-financing letter of guarantee according to the extent of exposure therewith Annual guarantee charges at no less than 2% of the exposure amount of letter of guarantee will be accrued for nonfinancing letter of guarantee according to the extent of exposure therewith Additional charges will be accrued at 1‰ of the amount of and at least RMB100/transaction for each letter of guarantee 19 / 28 Remarks No. Services Service Price Preferential Terms 1 ‰ ~ 3 ‰ of the amount shall be Letter of guarantee with full charged annually for the letter of full 411 cash deposit margin guarantee, and each one shall not be less than RMB 100. 412 Letter of commitment on loans No less than RMB 1,000 per transaction 413 Supervision business Pricing according to agreement and based on nature of transaction; ≤2% of the amountper annum in principle 414 Service Description Issuing letter of guarantee with full cash deposit Free of charge for micro and small enterprises Charges for bond repayment Pricing according to agreement and based and underwriting on product nature Charges for the letter of Bank Credit, loan commitment and the letter of intent Funds, bonds, asset management schemes and other fund supervision services provided by our Bank as fund supervisor(or in the capacity of custodian and creditor’ rights manager) at the request of the trustor(s) in compliance with the requirements of relevant policies and regulations (charges) Applicable to Remarks Corporate customer The charge standard for issuing a letter of guarantee pledged by the amount of treasury bonds or deposit certificate shall be implemented with reference to the charge standard for full margin Corporate customer Corporate customer and interbank clients Charges payable as agreed upon redemption of bond by bond issuer; our bank provides bond underwriting services, the issuer pays the underwriter handling fees according to the agreement Corporate customer Corporate customer (V) International business Domestic letter of credit Charges for the issuance of domestic letter letter of credit: 1.5‰ of the amount and at least RMB 100/transaction Charges for the issuance of domestic letter of credit Domestic letter of credit Fees for alteration of domestic letter of credit: RMB100/transaction Fees for alteration of domestic letter of credit 503 Domestic letter of credit Fees for confirmation of deferred payment under domestic letter of credit: 1‰ of the amount and at least RMB 100 on a quarterly basis 504 Domestic letter of credit Fees for discrepancy in domestic letter of credit:RMB 500/transaction 501 502 20 / 28 Corporate customer In event of capital increase: fees will be charged at the criteria for issuance of letter of credit with respect to the increased amount Fees for confirmation of deferred payment under domestic letter of credit Corporate customer Fees can be reduced or waived in case of letter of credit under low risk,while fees will be charged for any transaction that is yet to cover a whole quarter as if it covers a whole quarter Fees for discrepancy in domestic letter of credit Corporate customer Generally deductible from the beneficiary No. 505 506 Services Service Price Preferential Terms Domestic letter of credit Fees for notice/alteration notice regarding domestic letter of credit: RMB 50/transaction Fees for notice/alteration notice regarding domestic letter of credit Corporate customer Domestic letter of credit Fees for document verification relating to negotiation/entrusted collection for domestic letter of credit:1‰ of the amount and at least RMB 100/transaction Fees for document verification relating to negotiation/entrusted collection for domestic letter of credit Corporate customer Management and collection of accounts receivable (management fees) Corporate customer Domestic seller factoring, domestic refactoring and Creditor's financing 507 Domestic factoring business business shall be not less than 0.125% of the amount of accounts receivable charged Service Description Applicable to 508 Forfaiting Charge according to the relevant agreement Forfaiting fees Corporate customer 509 Domestic letter of credit payment Charge according to the relevant agreement Domestic letter of credit payment fee Corporate customer 510 Pledge with accounts receivable No less than 0.5% of the credit being granted Management and collection of accounts receivable (management fees) Corporate customer 511 Remittance Charges for outward remittance (corporate) Corporate customer 512 Remittance Charges for outward remittance (personal) Private customers 513 Remittance Alteration: RMB100/transaction Fees for alteration of outward remittance All customers 514 Remittance Return of remittance by beneficiary: charges will be accrued based on the amount of outward remittance Return of remittance by beneficiary All customers Charges for outward remittance (corporate): 1‰ of the amount and at least RMB50 and at most RMB1,000 Charges for outward remittance (personal): 1‰ of the amount and at least RMB20 and at most RMB500 515 Remittance Return of remittance by those other than beneficiaries: USD 10/transaction Return of remittance by those other than beneficiaries 516 Entrusted collection Clean collection: 1‰ of the amount and at least RMB 50 and at most RMB 1,000 Charges for clean collection Corporate customer 517 Entrusted collection Documentary collection: 1‰ of the amount and at least RMB 100 and at most 2,000 Charges for documentary collection Corporate customer 21 / 28 All customers Remarks Including telegram charges For returned remittance, deductible from the principal thereof; fees in in other currencies: EUR10/transaction, GBP10/transaction, HKD100/transaction, and JPY1,000/transaction No. Services Service Price 518 Entrusted collection 519 520 Preferential Terms Service Description Applicable to Inward collection: 1‰ of the amount and at least RMB 100 and at most RMB 2,000 Service charges for inward collection Corporate customer Entrusted collection Alteration relating to documentary collection: RMB 100/transaction Fees for alteration relating to documentary collection Corporate customer Entrusted collection Fees for return of documents relating to documentary collection: RMB 200/transaction Fees for return of documents relating to documentary collection Corporate customer 521 Letter of credit Fees for notification/transmission of export letter of credit: RMB 200/transaction Fees for notification/transmission of export letter of credit Corporate customer 522 Letter of credit Alteration notice/cancellation of export letter of credit:RMB 100/transaction Alteration notice/cancellation of export letter of credit Corporate customer 523 Letter of credit Transfer of export letter of credit: 1‰ of the amount and at least RMB 300 and at most RMB 2,000 Transfer of export letter of credit Corporate customer 524 Letter of credit Negotiation/document verification for export letter of credit: 1.25‰ of the amount and at least RMB 200 Negotiation/document verification for export letter of credit Corporate customer 525 Letter of credit Charges for issuance of import letter of credit: 1.5‰ of the amount and least RMB 300 Charges for issuance of import letter of credit Corporate customer 526 Letter of credit Fees for alteration of import letter of credit: RMB 100/transaction when borne by domestic client; USD 40/transaction when borne by overseas client 527 Letter of credit Fees for acceptance of letter of credit: 1‰ of the amount and at least RMB 100 on a quarterly basis Fees for acceptance of letter of credit Corporate customer 528 Letter of credit Fees for discrepancy: USD60/transaction Fees for discrepancy Corporate customer 22 / 28 Fees for alteration of import letter of credit Corporate customer Remarks If the letter of credit is negotiated at the Bank, relevant fees will be deductible from negotiation charges, covering the notification or transmission of the letter of guarantee Fees regarding other currencies: EUR40/transaction, GBP40/transaction, HKD400/transaction, JPY4,000/transaction, etc.; in event of capital increase: fees will be charged at the criteria for issuance of letter of credit with respect to the increased amount. Fees can be reduced or waived in case of letter of credit under low risk,while fees will be charged for any transaction that is yet to cover a whole quarter as if it covers a whole quarter Generally deducible from the beneficiary; in other currencies: EUR60/transaction, GBP60/transaction, CNY600/transaction, HKD600/transaction, JPY6000/transaction, or their equivalents in other currency at the exchange rate of that day No. 529 Services Letter of credit Service Price Preferential Terms Fees for absence of copies: USD10/transaction Service Description Fees for absence of copies Applicable to Remarks Corporate customer Generally deducible from the beneficiary; in other currencies: EUR10/transaction, GBP10/transaction, CNY100/transaction, HKD100/transaction, JPY1,000/transaction, or their equivalents in other currency at the exchange rate of that day Generally deducible from the beneficiary; in other currencies: EUR35/55, GBP35/55, CNY350/550, HKD350/550, JPY3500/5500, or their equivalents in other currency at the exchange rate of that day 530 Letter of credit Telegram charges for payment: USD35/ transaction (on-demand payment); USD55 per transaction (forward payment) Telegram charges for payment Corporate customer 531 Letter of credit Endorsement on bill of lading with bank as consignee: RMB100/transaction Endorsement on bill of lading with bank as consignee Corporate customer 532 Letter of credit Return of import letter of credit: RMB200/transaction Return of import letter of credit Corporate customer Letter of credit Guarantee for delivery of goods under import letter of credit: 0.5‰ of the amount per quarter and at least RMB 300 on a quarterly basis Guarantee for delivery of goods under import letter of credit 534 Letter of credit Fees for reissue: according to relevent agreement, at least 0.3‰ of the amount; Fees for alteration: RMB 30/transaction or charged at the criteria for reissue with respect to the increased amount; Fees for acceptance: RMB 200/transaction Charges for reissue of documentary credit Corporate customer and interbank clients 535 Letter of guarantee Payment guarantee: 1.5‰ of the amount per quarter and at least RMB 500 on a quarterly basis Charges for issuance of payment guarantee Corporate customer 536 Letter of guarantee Tender guarantee: charge at 0.5‰ of amounts per quarter and at least RMB 500 on a quarterly basis Charges for issuance of tender guarantee Corporate customer 537 Letter of guarantee Performance guarantee: 1‰ of the amount per quarter and at least RMB 500 on a quarterly basis Charges for issuance of performance guarantee Corporate customer 538 Letter of guarantee Advance payment guarantee: 1‰ of the amount per quarter and at least RMB 500 on a quarterly basis Fees for issuance of advance payment guarantee Corporate customer 533 539 Letter of guarantee Financial letter of guarantee:2‰-6‰ of the amount per quarter, and at least RMB 1,000 on a quarterly basis Charges for financial letter of guarantee 23 / 28 Corporate customer Corporate customer Fees will be charged for any transaction that is yet to cover a whole quarter as if it covers a whole quarter, or at RMB 300/transaction relating to guarantee with full cash deposit Fees will be charged for any transaction that is yet to cover a whole quarter as if it covers a whole quarter at a price specific to each business approved by relevant authority and according to relevant agreement No. 540 Services Service Price Letter of guarantee Other letters of guarantee: 0.5‰-2‰ of the amount per quarter and at least RMB 500 on a quarterly basis Preferential Terms Service Description Applicable to Charges for issuance of other letters of guarantee Corporate customer 541 Letter of guarantee Alteration of letter of guarantee: RMB 100/transaction when borne by domestic client; USD 40/transaction when borne by overseas client 542 Letter of guarantee Claim under letter of guarantee: 0.625‰ of the amount and at least RMB 500 Charges for claim under letter of guarantee Corporate customer Letter of guarantee According to relevant agreement, no less than 2‰of amount guaranteed per year and at least RMB500 on a quarterly basis, at most 2.4% of amount guaranteed per year Charges for reissue of demand guarantee Corporate customer and interbank clients Telegram charges for domestic remittance All customers Telegram charges for overseas remittance All customers 546 Other international business RMB 200/transaction Telegram charges for inward collection and payment All customers 547 Other international business RMB 200/transaction Telegram charges for issuance of letter of credit/guarantee 543 544 Other international business RMB 80/transaction 545 Other international business RMB 80/transaction (Hong Kong and Macao); RMB 120/transaction (overseas) Fees for alteration of letter of guarantee Corporate customer 548 Other international business RMB 100/transaction Telegram charges for alteration of letter of credit/guarantee RMB 100/transaction when borne by 549 Other international business domestic client; USD15/transaction when borne by overseas client Fees for correspondence 24 / 28 Remarks Fees regarding currencies: EUR40/transaction, GBP40/transaction, HKD400/transaction, JPY4,000/transaction, etc.; in event of capital increase: fees will be charged at the criteria for issuance of letter of guarantee with respect to the increased amount Only with cross-border guarantee and fees will be charged for any tranction that is yet to cover a whole quarter as if it covers a whole quarter. Corporate customer Corporate customer All customers Generally deductible from the beneficiary; fees regarding other currencies: EUR10/transaction, GBP10/transaction, CNY100/transaction, HKD100/transaction, JPY1,000/transaction Fees regarding other currencies: EUR10/transaction, GBP10/transaction, CNY100/transaction, HKD100/transaction, JPY1,000/transaction, or their equivalents in currency at the exchange rate of that day No. Services Service Price Preferential Terms Service Description Applicable to 550 Other international business RMB 100/transaction Verification of seal and collateral Corporate customer Pricing according to agreement and based 551 Other international business on nature of transaction, not higher than 1% of the financing amount per annum Fees for cross-border financing arrangement Corporate customer Remarks (VI) Settlement business 601 Inter-bank inquiry on bank accepted draft RMB 30/transaction Inter-bank inquiry on bank accepted draft All customers 602 Charges regarding written report of losing savings bankbook (receipt) Free of charge Affairs regarding written report of losing savings bankbook (receipt) Individual customer 603 Annual fee for savings account management Free of charge Savings account management Individual customer 604 Account service RMB 50 per time for each account Account opening Corporate customer Preferential from September 27, 2021 to September 30, 2024 605 Account service RMB 10 per time for each account Account information changes Corporate customer Exempted when the capital verification account becomes a basic deposit account 606 Account service RMB10 per time for each copy Reprinting of receipt Corporate customer “Each copy” refers to the action of conducting this business, measured by times 607 Account service Within the year: RMB10 per time for each copy; Beyond the year: RMB20 per time for each copy Reprinting of bank statement Corporate customer 608 Account service RMB 10 per time for each account Seal change Corporate customer 609 Account service RMB 50 per time for each account Report of losing seal Corporate customer Fees for creation of vouchers sold to customers All customers Free of charge for small and micro enterprises and individual businesses Application for bank draft and bank note: free of charge Telegraphic transfer voucher:RMB 2.5 each Mail transfer voucher: RMB 2.5 each Sorter deposit receipt:RMB 5.5 each General deposit receipt:RMB 2 each Discount voucher:RMB 3 each 610 Fees for creation of vouchers Collection voucher:RMB 2.5 each Certificate of dishonor:RMB 2.5 each Cash deposit receipt:RMB 2 each Commercial acceptance draft:RMB 12 each Bank acceptance:RMB 12 each Claim check for blank and important vouchers:RMB 2.5 each 25 / 28 No. 611 612 Services Entrusted collection and acceptance PBOC Express (Chongqing) Service Price Preferential Terms Service fee:RMB 1/transaction Postage (including EMS): collected according to specific standards of the Post Office Service Description Applicable to Remarks Corporate customer and individual customer Charging for entrusted collection and acceptance is based on round-trip postage. And the overweight postage should be charged accourding to the standards of the Post Office,when there are too many accompanying documents. Remittances through the Chongqing Payment Information Integrated Service System only Corporate customer and individual customer (1) For urban branches, when corporate customers use check in transfer, it is free of charge. When corporate customers use wire transfer voucher, criteria of People’s Bank of China shall be followed; (2) When a suburban branch is involved, criteria of local People’s Bank of China shall be followed. (3) Such rules are only applicable to the business within Chongqing. Similar business at non-local branches shall follow rules of the local People’s Bank of China (4)The preferential policy for inter-bank transfer and remittance business starts from September 27, 2021 to September 30, 2024. Corporate deposit certificate Corporate customer Affairs regarding to application of entrusted collection and acceptance (1) Personal inter-bank transfer: RMB2 for transfer of RMB2,000 or less; RMB 3 for transfer of RMB2,000 - RMB 50,000 (inclusive); RMB5 for transfer of RMB50,000 RMB100,000 (inclusive); RMB10 for transfer of RMB100,000 RMB500,000 (inclusive); RMB15 for transfer of RMB500,000 RMB1 million (inclusive); 0.002% of the transfer amount (RMB50 in maximum) for transfer above RMB1 Small and micro enterprises and individual businesses will million (2) Corporate inter-bank transfer: receive a 10% discount for inter-bank transfer and RMB3 for transfer of RMB 50,000 or less; remittance of less than RMB100,000 RMB5 for transfer of RMB50,000 RMB100,000 (inclusive); RMB10 for transfer of RMB100,000 RMB500,000 (inclusive); RMB15 for transfer of RMB 500,000 RMB 1 million (inclusive); 0.002% of the transfer amount (RMB200 in maximum) for transfer above RMB1 million (3) Personal cash remittance: 0.4% of remittance amount of and at most RMB50 for each transaction 613 Corporate deposit certificate RMB 200 for each one 614 Corporate loan certificate RMB 100 for each one Corporate loan certificate Corporate customer 615 Settlement discipline certificate RMB 200 for each one Settlement discipline certificate Corporate customer The Bank verifies and comfirms the contents of bank confirmation request Corporate customer 616 Bank confirmation request RMB 200 for each one Free of charge for small and micro enterprises and individual businesses defined by Ministry of Information Technology,Bureau of Statistics,Ministry of Finance,National Development and Reform Commission 《 Notice on printing and distributing the provisions on the classification standards for small and medium-sized enterprises》([2011] No.300) 26 / 28 Preferential from May 1,2022 No. Services Service Price Preferential Terms 617 Personal deposits certificate RMB 20 for each one 618 Settlement service charge of Charge according to the contract special merchant 1. From September 30, 2021 to September 30, 2024, special merchants will be offered discounts on bank card swiping fees. The discounts are as follows: standard merchants will be offered a 10% discount on debit card swiping fees with the maximum value remaining unchanged, and preferential merchants will be offered a 7.8% discount. 2. From January 1, 2022 to December 31, 2022, special merchants will be provided with fee reduction and exemption, a single merchant will be exempted from the maximum FEE of RMB1,000 per month for TWODIMENSIONAL code transactions. Service Description Applicable to Personal deposits certificate Individual customer Remarks Bank card acquiring business and fund settlement services for special merchants All customers 1. Discount period for bank card handling fee: September 30, 2021 to September 30, 2024. 2. Discount period of twodimensional code transaction handling fee: January 1, 2022 to December 31, 2022 Service fee for CFCA certificate Individual customer Preferential from January 1, 2023 to June 30, 2025 Fees for making Usbkey Individual customer Preferential from January 1, 2023 to June 30, 2025 (VII) Internet Business 701 702 Digital certificate of personal RMB 5 for each one online banking Free of charge Usbkey for online banking of Usbkey: RMB 35 each personal online banking Free of charge for customers who completed any of the following businesses . ①To open mobile banking under signed agreement. ②To purchase financial product of no less than RMB 100,000. ③To make regular fixed fund investment at no less than RMB 600 per month under signed agreement. ④To engage in 1 or more installment payments with credit card issued by Bank of Chongqing 703 OTP for mobile banking OTP: RMB 16 each Free of charge at present Fees for OTP Individual customer Preferential from January 1, 2023 to June 30, 2025 704 Charges for inter-bank transfer through personal online banking Real-time transfers:RMB 2/traction Regular transfers:RMB 3/traction Free of charge at present Charges for RMB settlement Individual customer Preferential from January 1, 2023 to June 30, 2025 705 Charges for inter-bank transfer through mobile banking Real-time transfers:RMB 2/traction Regular transfers:RMB 3/traction Free of charge at present Charges for RMB settlement Individual customer Preferential from January 1, 2023 to June 30, 2025 Enterprise version of e-banking:Discounted price of RMB 100 at present Small and micro enterprise version of e-banking:free of charge Service fee for CFCA certificate Corporate customer Offer expiration date:September 30, 2024 Digital certificate of corporate 706 RMB 200 for each one online banking 27 / 28 No. 707 Services Service Price Preferential Terms Usbkey for online banking of Usbkey (first generation): RMB30 each corporate online banking Service Description Applicable to Remarks Corporate customer From September 30, 2021,small and micro enterprises and individual businesses will not charge higher than the cost price. The preferential period is from September 30, 2021 to September 30, 2024 Fees for making Usbkey Corporate customer From September 30, 2021,small and micro enterprises and individual businesses will not charge higher than the cost price. The preferential period is from September 30, 2021 to September 30, 2024 Fees for making Usbkey 708 Usbkey for online banking of Usbkey (second generation): RMB 35 corporate online banking each 709 Charges for inter-bank transfer through corporate online banking (general / next day) RMB 2 for transaction of RMB 50,000 or Small and micro enterprises and individual businesses will less; receive a 10% discount for inter-bank transfer and RMB 5 for transaction above RMB 50,000 remittance of less than RMB100,000 (inclusive) Charges for RMB settlement Corporate customer Preferential from September 27, 2021 to September 30, 2024 Charges for inter-bank transfer through corporate online banking (instant) RMB 5 for transaction of RMB10,000 or less; RMB10 for transaction of RMB 10,000 - RMB100,000 (inclusive); RMB15 Small and micro enterprises and individual businesses will for transaction of RMB100,000 RMB500,000 (inclusive); RMB20 for receive a 10% discount for inter-bank transfer and transaction of RMB 500,000 - RMB 1 remittance of less than RMB100,000 (inclusive) million (inclusive); and 0.002% of the transfer amount (RMB 200 in maximum) for transaction above RMB1 million Charges for RMB settlement Corporate customer Preferential from September 27, 2021 to September 30, 2024 710 Small and micro enterprise version of e-banking:free of charge IV. Newly added or price increased service items in this year Notes: 1.The preferential treatment for small and micro enterprises and individual businesses to pay service fees shall be implemented in accordance with "Notice on Reducing Service Charges for Small and Micro Enterprises and Individual Businesses(Yin Fa[2021] NO.169)". Small and Micro Enterprises refer to the regulations of the Ministry of Industry and Information Technology. And Individual Businesses refer to regulations of Market Regulatory Authority. 2. Businesses such as foreign exchange settlement and sale, foreign exchange arbitrage dealing for customers, shall be handled according to the buying/selling prices quoted by Bank of Chongqing or wholesale inquiry rate. Customers can convert the deposit or cashto another currency according to the current dealing rate. Customers can withdraw cash from the foreign currency account, and the same currency conversion will be charged for free. Customers can also convert the cash into the notes among different currencies according to the buying/selling prices including the same currency. the postage is collected according to the quotation of China Post or express delivery companies; fees payable to other banks incurred in various businesses by customers shall be collected according to actual situations; for intermediate businesses with other banks, fees are charged according to agreement; and fees in foreign currency for above businesses can be collected in other currencies after conversion at the exchange rate on relevant trading day. 3.The same-city business covers an area of an administrative prefecture , and business within the same municipality directly under central government, capital city and municipality with independent planning status are also deemed as same-city business. 4. E-mail address for complaints is the Asset Liability Management Department, No.6, Yongpingmen Road, Jiangbei District, Chongqing Municipality; Bank of Chongqing National Customer Service Hotline 956023; Consumer complaint reporting hotline 12315; Dedicated complaint hotline for “non-compliance operation”: 023-60330784. 28 / 28

《重庆银行服务收费价格目录》(2023年版).pdf

《重庆银行服务收费价格目录》(2023年版).pdf